The Collective Investment Law 2010 (DIFC Law No. 2 of 2010), the Collective Investment Rules (CIR), Module of the DFSA Rulebook and the Regulatory Law of the DIFC (DIFC Law No. 4 of 2004) are the primary components of the DIFC Collective Investment Funds Regime (the DIFC Funds Regime). The DIFC Funds Regime is regulated by the Dubai Financial Services Authority (DFSA).

The Main Objectives of the DIFC Funds Regime

With a view to making the DIFC a feasible jurisdiction for establishing funds, the DFSA made changes to its collective investments law following consultation with industry experts. The legal framework is based on the International Organization of Securities Commission (IOSCO) principles for regulating collective investment schemes.

The DIFC Funds Regime primarily focuses on the following:

- formation and structure of investment funds in the DIFC;

- fund management; and

- fund administration.

Kinds of Funds

Under the DIFC Funds Regime, there are two kinds of funds: (i) Domestic Funds; and (ii) Foreign Funds.

Domestic Fund

A Domestic Fund is a fund which is either (i) established or domiciled in the DIFC; or (ii) it is established or domiciled in a jurisdiction other than the DIFC and managed by a Fund Manager which is an Authorized Firm (External Fund).

Foreign Fund

A Foreign Fund is a fund which is established or domiciled in a jurisdiction other than the DIFC, but is not an External Fund.

Type of Funds

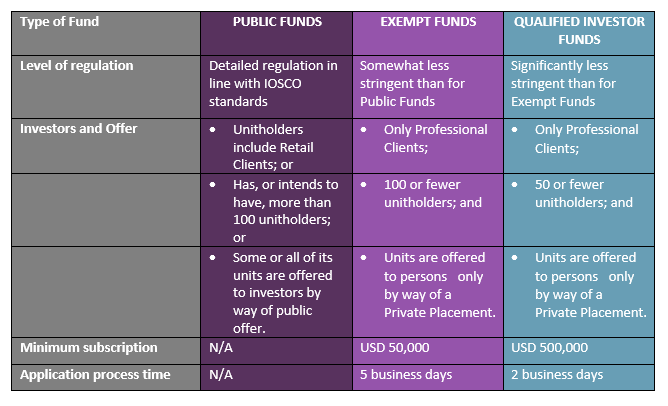

Domestic Funds can be of three types:

Additionally, a Specialist Fund can be classified in one of the following categories – Islamic funds, fund of funds, feeder funds, master funds, private equity funds, property funds, real estate investment trust, hedge funds or umbrella funds. There are specific regulatory requirements applicable to Specialist Funds. For example, with respect to hedge funds, the risks associated with the fund must be managed by the adequate segregation of duties between the investment function and the fund valuation process; property funds must be close-ended funds and must invest only in real property or property related assets; and Islamic Fund Managers have to appoint a Shari’a Supervisory Board (SSB).

Fund Structure

Domestic Funds can be established based on one of the following structures: (i) Investment Companies; (ii) Investment Trusts; and (iii) Investment Partnerships.

Investment Company

An Investment Company is required to be incorporated in the DIFC and the Fund Manager should be a corporate director of the Investment Company. An Investment Company can also use the Protected Cell Company structure.

Investment Trust

An Investment Trust is set up by a trust deed entered into between the Fund Manager and the Trustee. The Trustee is not required to be a DFSA licensed Trustee – a Trustee can be a custody provider, or a person regulated and supervised in a Recognized Jurisdiction for custody or depository services. The Trustee is required for safe-keeping of fund property, the maintenance of the Unitholder register, and to monitor whether the fund is managed in accordance with the trust deed and the applicable laws.

Investment Partnership

An Investment Partnership is a limited partnership registered in the DIFC, comprised of a general partner and limited partner(s). The general partner must be authorized by the DFSA to act as the Fund Manager.

Fund Management

Under the DIFC Funds Regime, Domestic Funds can be managed by (i) Domestic Fund Managers; or (ii) External Fund Managers.

Domestic Fund Manager

A Domestic Fund Manager is a body corporate established in the DIFC as an Authorized Firm licensed by the DFSA to carry on the Financial Services of Managing Collective Investment Funds.

External Fund Manager

An External Fund Manager is a Fund Manager licensed in a jurisdiction acceptable to the DFSA. The External Fund Manager is required to appoint a DIFC authorized fund administrator or trustee.