A landmark victory in the Supreme Court has seen a Northern Ireland woman win a share of her former partner’s pension, with commentators saying it’s likely to add impetus to the drive for greater rights for unmarried couples. But, in the meantime, cohabitees should face up and formalise arrangements rather than keeping their fingers crossed.

The victory of Denise Brewster involved her claim for a survivor’s pension after her long-term, live-in partner Lenny McMullan died suddenly, shortly after they had become engaged. He had paid into Northern Ireland’s local government pension scheme but had not completed the necessary form to nominate a cohabiting partner for a survivor’s pension. Denise Brewster took legal action to claim the pension, and when her case reached the Supreme Court, the judges ruled that refusing to pay her was unlawful.

Such difficulties play out all too often for cohabiting couples, whether in relation to shared property or what happens to their assets when they divorce or die. Many still believe in the idea of so-called ‘common law marriage’, assuming they have legal rights like married couples or civil partners on death, only to discover the harsh truth when problems arise.

Currently, securing protection requires action to be taken by the couple if they wish to ensure that the interests of both parties are protected in case of death, separation or other life changes.

Family lawyer Pippa Marshall said:

“It may seem unfair, but cohabiting couples do not have the protection that comes with marriage or civil partnership. There are three main areas where couples should look to protect themselves, and each other, and that’s with a cohabitation agreement, formalising how property is owned and each making a will. These all help to avoid uncertainty and come into their own if the worst happens.”

Making a Will

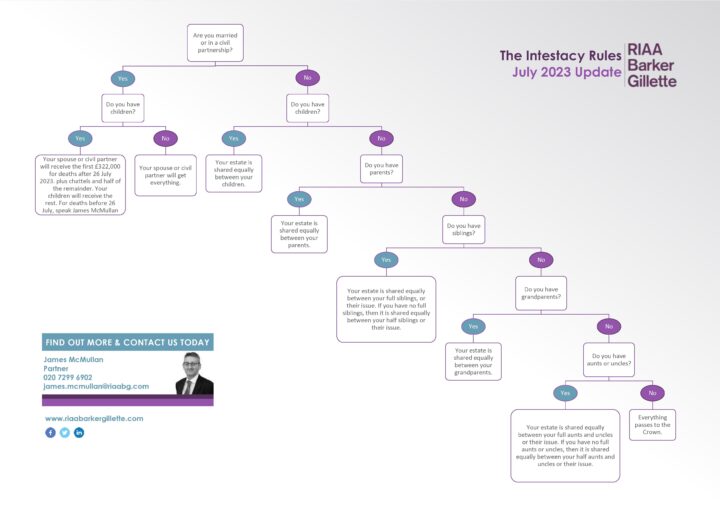

Head of Private Client, James McMullan, explains that without a valid Will, the Intestacy Rules will decide the division of assets belonging to a cohabitee. Under these rules, a cohabiting partner will not be included. Typically, the whole of their estate would go to children, or if they have none, to parents or other family members.

Although the surviving cohabitee could apply for “reasonable financial provision” under the Inheritance (Provision for Family and Dependants) Act 1975, this option would be very slow and potentially expensive. In the meantime, they may be blocked from living in the couple’s home if it is not held in shared ownership.

Inheritance Tax

Writing a Will is also a good time for couples to consider inheritance tax implications, as they will not benefit from the exemption given to gifts between spouses and civil partners. Also, unlike a married couple or civil partners, the first-to-die’s nil rate band cannot be transferred to the survivor.

Property Ownership

Regarding property ownership, our property partner, Ben Marks, reiterated that if a couple buys a property together or agrees, one has become entitled to a share. Ownership must be structured to reflect this and the intentions of each upon death. Such ownership must be formally documented and ideally recorded at the Land Registry. If the property is owned as ‘joint tenants’, there are two consequences:

- the couple is electing not to own separately defined shares in the property, and if anything is done to bring the joint ownership to an end, the couple will own the property in equal shares.

- Upon the death of one, the whole property will pass automatically to the other regardless of the intestacy rules or any Will.

If a property is owned as tenants in common, then each will own a specific share – which can be in any proportions, by any agreed calculation – and each is free to choose what will happen to their share of the property on death. This aspect should also be considered when a Will is written, as someone may wish to leave their share to children, but with the survivor having the right to continue living in the house until their death or relocation.

Cohabitation Agreements

Cohabitation Agreements are formal agreements outlining what will happen if a couple separates. Cohabitation agreements can also set out day-to-day matters, such as who is responsible for household expenditure and in what proportions. As well as helping to settle disputes when a relationship ends, by referring to the original intention, it can be useful to clarify matters before a couple moves in together by encouraging discussion and agreement over the details.

Cohabitation Agreements should be drawn as a deed, independently witnessed. For instance, both parties should demonstrate there was no duress by seeking independent legal advice. A cohabitation agreement may be set aside or varied by the courts if the circumstances change, for example, if the couple has children, so it is important to review what has been put in place regularly.

Speak to Pippa Marshall for more information on how unmarried couples can protect themselves.

Note: This is not legal advice; it provides information of general interest about current legal issues.