When someone close to you dies unexpectedly, you are often left in a state of shock and bewilderment.

We aim to set out some of the immediate steps to be taken when sudden death occurs and highlight a few topics you should consider discussing with a solicitor, depending on your unique circumstances.

Immediate steps

If you are with the deceased when they die, you will need to phone the emergency services, who depending on the circumstances of the death, may organise a post-mortem to find out its cause.

Shortly thereafter, you must contact a local funeral director to make arrangements. Note the body can only be released to them once the authorities are satisfied with the post-mortem results and a death certificate has been provided.

The hospital will provide the next of kin with the necessary papers to take to the Registry Office for Births, Marriages & Deaths. The death must be registered within five days unless there are exceptional circumstances. Note, if the death is reported to the coroner, the death cannot be registered until the coroner gives permission (although, in some cases, an “interim certificate” may be provided pending the final decision of the coroner.

The Registrar will issue the death certificate and provide you with as many copies as you wish (for a nominal fee). Once the funeral directors have a copy of the certificate, they can collect the body from the hospital.

The family must then consider various questions. Who has the right to decide how the body is disposed of? Burial or cremation? The answer to these questions can raise sensitive issues. It is best to try and resolve these matters amicably rather than risk a breakdown in family relations and incur legal costs arguing over this.

Strictly speaking, the legal position is that there is no property in a corpse, so the estate’s beneficiaries cannot “claim” any rights over the body. The personal representatives (the PRs) of the estate are responsible for disposing of the body.

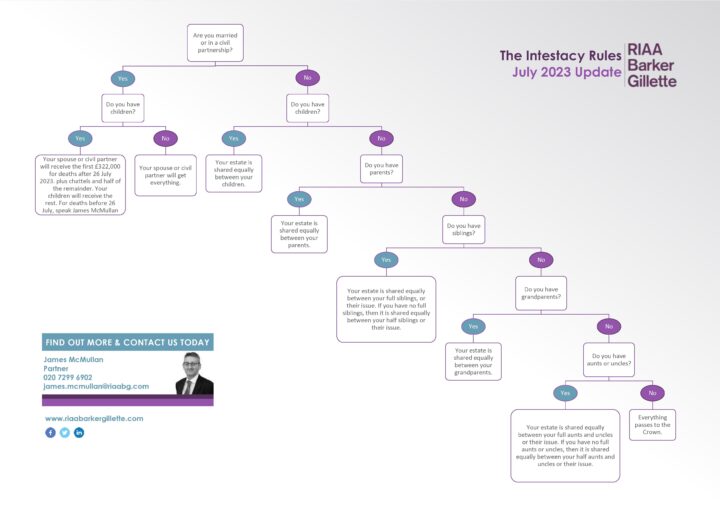

If the deceased made a will, the executors are the PRs. If they died intestate (without a valid will), the PRs are the administrators of the estate (persons chosen in accordance with the Intestacy Rules).

The deceased’s true wishes are often expressed in their will or a side letter which may be kept with it.

Is there a will?

It is important to check for a will by going through the deceased’s personal papers, making enquiries with their bank, building society, or family solicitor and/or carrying out a search of the National Wills Register to see if there is a valid will. We can, of course, do this for you.

If there is a valid will, it will confirm the executors’ details and how the estate should be distributed and may confirm any funeral directions. If no will can be found, the deceased’s estate will be distributed in accordance with the Intestacy Rules, which are not always as straightforward as one would think.

The estate

Once the PRs have been identified and have agreed to act, they will need to uncover all of the details of the estate (all of the deceased’s assets and debts). This will involve gathering up their papers and providing the details of any assets (bank account statements, pension fund details, savings and investments, life insurance etc.) and any debts (mortgages, loans, HP agreements, etc.). The PRs must notify the deceased’s bank and any other financial institutions of the death.

- Bank accounts: If a bank account is in the deceased’s sole name, the account will be frozen. If a joint account, the deceased’s name will be removed from the account, and the survivor will usually be entitled to the funds in that account.

- Funeral expenses: The PRs will usually incur the costs of making the funeral arrangements. Such expenses, provided they are reasonable in relation to the deceased status in life and the size of his estate, will be deducted from the estate before other unsecured debts. Although the deceased’s bank accounts may be frozen, this is one instance where the banks are permitted to release funds to pay the funeral directors directly.

- Administration of the estate: Once the funeral has taken place, the PRs should progress the administration of the estate and implement the wishes of the will (or process the estate in accordance with the Intestacy Rules).

- Now, the difficult bit… Inheritance Tax: If Inheritance Tax is payable on the estate (any estate worth over £325,000 (but subject to other exemptions and reliefs that may be available), a complete and accurate Inheritance Tax account should be prepared and lodged with HM Revenue & Customs as soon as possible. This is usually the most difficult part of the process. The Inheritance Tax account must be completely accurate. HM Revenue & Customs are now levying penalties against PRs where care has not been taken to provide an accurate Inheritance Tax account. Interest starts to run on the Inheritance Tax liability six months after the end of the month of death, so the clock is ticking.

Rest assured, we draft, advise on and assist with Inheritance Tax accounts as part of our service.

James McMullan, Head of Private Client, RIAA Barker Gillette (UK) LLP

All told, the probate process contains many traps and pitfalls. In all but the most straightforward of cases, you should consider taking advice from a solicitor.

For more information, contact James McMullan today.

Note: This article is not legal advice; it provides information of general interest about current legal issues.