The European Convention on Human Rights gives everyone in the UK a right to freedom of thought, conscience and religion. This includes the freedom for an individual to live and die following their faith. This, coupled with English law’s principle of testamentary freedom, allows everyone over the age of 18, with mental capacity, to create a will.

Accordingly, a Muslim over 18 years old with full mental capacity has the right to dispose of his or her assets in accordance with Sharia law, subject to compliance with English law.

How to create an Islamic will

The legal requirements set out in section 9 of the Wills Act 1837 must be complied with for a will to be valid. In brief, a will must be:

- in writing;

- signed with the intention to give effect to the will; and

- signed in the presence of two or more witnesses.

As with any will, care should be taken in selecting any executor(s). Sharia law recommends choosing Muslim men who have knowledge of Sharia law as their knowledge will assist them in making decisions during the estate administration. For example, investing monies in a trust fund in accordance with Islamic finance rules. Further, the will should declare the testator’s intention to follow Sharia law. This will be useful should the will be challenged.

Documenting any funeral wishes within your will, including any preferred burial site, is also useful. Many Islamic wills directly object to having an autopsy, although that will likely be a matter for English law and the relevant authorities.

Sharia law sets out strict rules determining how an individual’s assets are administered upon death. These have been prescribed in the Quran and are vastly different to English law.

Failing to create a will, Islamic or otherwise, will result in the deceased’s personal assets being distributed in accordance with the Intestacy Rules.

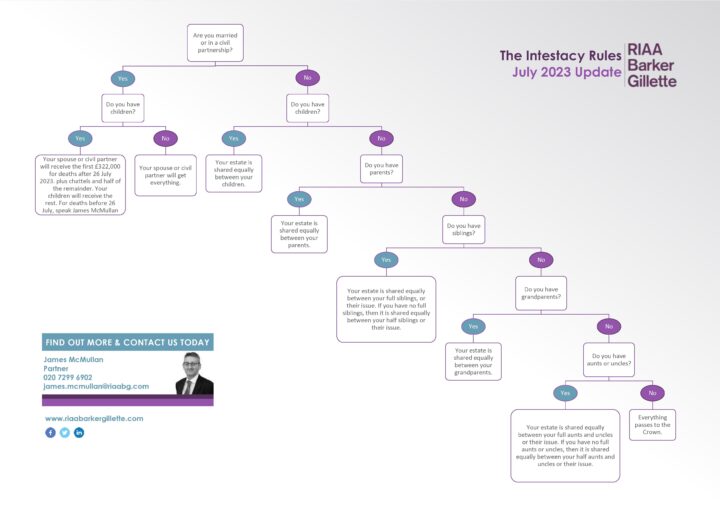

For a simple guide to the Intestacy Rules, see our flowchart below(a larger copy of which can be found here):

For a larger copy of the above image, click here.

These distribution rules are vastly different from those set out in the Quran. Beneficiaries under the Intestacy Rules may elect to distribute the estate in accordance with Sharia law. However, it may not be in their interest to do so, and the lack of a will can lead to family disputes.

Sharia law and estate planning

In England and Wales, estates over £325,000 are subject to a 40% Inheritance Tax, subject to any other available reliefs and exemptions. Sharia law is not the most tax-efficient way to distribute an estate as it does not fully utilise reliefs and exemptions available such as the residential nil rate band (also known as the “additional threshold”) or a spouse’s exemption.

Lifetime estate planning can assist in reducing the Inheritance Tax payable under Sharia law distribution.

Before creating an Islamic will speak to our wills, tax and trusts specialist, James McMullan, to ensure you create a valid will, attempt to minimise your Inheritance Tax liability and avoid potential claims against your estate under the Inheritance Act.

You should review your will every 18 to 24 months and whenever a life-changing event occurs, such as a birth, death, marriage*, divorce or an increase in wealth.

* It is important to note that a marriage revokes a will in its entirety, but a divorce does not, although a gift in a will to a spouse who is later divorced by the testator will be treated as if the spouse had pre-deceased.

Note: This is not legal advice; it provides information of general interest about current legal issues.