What is the Gender Pay Gap?

The Gender Pay Gap (GPG) is the difference between men and women’s hourly pay. Historically, men have been paid more than women undertaking the same role. In July 2015, former PM David Cameron announced steps to end the GPG in a generation. A consultation hotly ensued, followed by draft regulations to introduce mandatory GPG reporting. The final draft of those regulations has now been published and come into force, subject to Parliament’s approval, on 6 April 2017.

Several important changes have been made to the draft regulations following a consultation. These include:

- the introduction of the concept of a “full-pay relevant employee” to exclude those on sick leave or maternity leave from the comparison;

the exclusion of partners and LLP members; - a change in the “snapshot date” to 5 April;

- a clearer ‘bonus’ definition;

- a requirement to publish the difference in both the mean and median bonus figures; and

- clarification of how the quartile pay bands are calculated.

The first GPG reports, based on April 2017’s pay data, are due by 4 April 2018. Employers must make these figures available and accessible to all for at least three years on both their own website and a central government website.

Who is covered?

Relevant employers: Employers in Great Britain with 250 or more employees on the “relevant snapshot date” (5 April 2017 and every 5 April thereafter). Public sector employers are currently outside scope, although similar reporting obligations are intended.

Relevant employee: “a person who is employed by the employer on the relevant snapshot date”. Explanatory notes confirm that the wider definition of employment will apply and will include workers and self-employed contractors.

Earlier drafts limited the definition to those ordinarily working in Great Britain under UK law. However, this could cause complications for UK employers with overseas employees.

Partners (including LLP members) are excluded. This may save some red faces for any predominantly male partnerships and LLPs.

Employees are excluded from the reporting obligation if they receive less than full pay because of leave. This seeks to avoid any distorted figures where employees are on statutory maternity pay or unpaid maternity leave on 5 April. Only full pay relevant employees are considered on 5 April for the calculations relating to mean and median hourly rates of pay, or the proportion of male and female employees in each quartile.

All relevant employees are included in the bonus figures.

What is pay?

The definition of ordinary pay has been overhauled and now means:

- Basic pay

- Allowances (but not out-of-pocket expenses)

- Pay for piecework

- Pay for leave (but only if fully paid leave otherwise the employee is excluded)

- Shift premium pay

GPG reporting is based on the “hourly rate of pay”, which includes both ordinary pay and “bonus pay” paid during the relevant pay period. Where bonus pay is referable to a bonus period longer than the relevant pay period, as in the case of an annual bonus, then only a pro rata amount is considered.

The regulations provide guidance as to how employers must calculate employees’ hourly pay, adopting a 12-week reference period for employees whose working hours vary from week-to-week.

Bonus pay is defined as:

“any remuneration that is in the form of money, vouchers, securities, securities options, or interests in securities, and relates to profit sharing, productivity, performance, incentive or commission”.

The relevant period for bonus pay reporting is the 12-month period ending on the snapshot date. This means that for the first GPG report, employers will need to take account of bonuses paid between 6 April 2016 and 5 April 2017 to all relevant employees (not just full pay relevant employees). Employees who have taken maternity leave are included, even though their bonus is likely to have been less as a result.

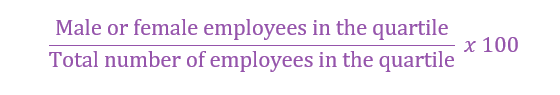

The basic reporting requirement for quartiles has not changed since the previous draft. The proportion of female full-pay relevant employees, in each quartile pay band, must be expressed as a percentage of the full-pay relevant employees within that band i.e.:

What to publish?

Median and mean GPG figures for pay, based on the hourly pay of “full pay relevant employees” during the relevant pay period (including a pro rata proportion of any bonuses paid during the period).

Median and mean GPG figures for bonuses paid in the year ending with the snapshot date.

The % of men and the % of women who received a bonus.

The number of men and the number of women in each pay quartile.

The figures must be accompanied by a written statement of accuracy, signed by a director, partner or equivalent. As stated, these figures must then be published on the employer’s website and a central government website, with the name and job title of the person who signed the statement of accuracy.

What happens if you don’t comply?

The regulations make no provision for enforcement. The Explanatory Memorandum indicates that failure to comply will constitute an “unlawful act” within the meaning of section 20 of the Equality Act 2006. That provision empowers the Equality and Human Rights Commission to take enforcement action. This was not specified in the original draft of the regulations. The Commission has previously stated, that it would:

“…require additional powers, and resources, to enable it to enforce compliance with the regulations, because its current powers are not suitable for enforcing, in a proportionate manner, a failure to publish.”

The government has suggested that a “naming and shaming” approach may be taken, although no details have been published as yet.

Help?

The draft Memorandum states that supporting non-statutory guidance will be published after Parliament has approved the regulations. ACAS has also indicated that it will be producing guidance in the new year.

For more information, contact employment lawyer Karen Cole.

Note: This is not legal advice; it provides information of general interest about current legal issues.