Photo by Melinda Gimpel on Unsplash

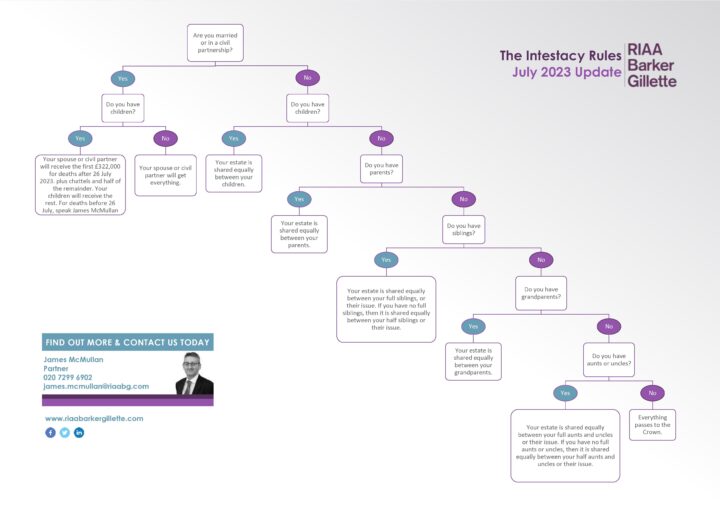

If you don’t make a will and die intestate, the government will make one for you by way of the Intestacy Rules. So, to encourage these 5.4 million adults to make a will, we’ve debunked some of the myths about what happens when you die intestate.

Everything I have will pass to my husband/wife/civil partner (spouse)

Not necessarily. If you are married or in a civil partnership and do not have children, only then will everything pass to the surviving spouse.

Having children changes the rules. If you have children, your spouse will only be entitled to:

- the first £250,000 of your estate

- your personal possessions

- half of the rest of your estate

The remaining half will be placed into a statutory trust for your children until they reach the age of 18 (or when they marry if earlier).

Everything will pass to my common-law partner

Wrong! The concept of a common-law partner itself is a myth. These relationships are not recognised by English law.

The fact is if you are not married or in a civil partnership, your partner will not inherit anything unless you have created a will. This is also true if you have children with your partner. While your child will be able to inherit, your partner will be left with nothing.

It’s cheaper to die without a will

This depends on the assets in your estate. Some assets, e.g., property held in the deceased’s sole name or as tenants in common can only be transferred if there is a Grant of Probate. Sometimes, banks also require sight of a Grant of Probate before they close bank accounts.

The process of applying for a Grant of Probate can be time-consuming and expensive. The Intestacy Rules dictate who will be entitled to make an application for a Grant. You may not think that this person would be the best one because of their age, health or even their physical location. It may also be necessary to have a genealogical report to research and identify any lost or unknown relatives. These reports can cost thousands of pounds. An intestate estate is generally more complex and therefore more expensive to administer.

As mentioned above, your long-term partner will not be entitled to anything if you are not married or in a civil partnership. Your partner, or anyone else who was dependent on you, risk having to make an application to the court for reasonable financial provision. Again, costing time and money.

I’m still young and I have time to make a will

There’s no guarantee. While everyone hopes that they will live a long and healthy life, no one knows what’s around the corner. You must make your wishes clear so that everybody knows how you want your assets distributed. This is even more important with business assets, as the people who will inherit if you die intestate (under the Intestacy Rules) may not be the best ones to run your business and help it flourish.

Why should I make a Will?

A will can make it easier for your family to manage an already traumatic experience.

If your circumstances change, you can easily update your will to reflect your new wishes. It’s a good idea to review your will whenever there’s a major life-changing event such as a birth, a death, a marriage or a divorce.

A will is not limited to disposing of your assets:

- If you have children, you can nominate guardians.

- If you are supporting someone vulnerable or with a disability, you can ensure they continue to receive assistance when you have gone.

- If you have a pet, you can leave funds for someone to look after your pet.

A solicitor, so far as possible, can ensure your will is drafted in the most tax-efficient way for your family.

If you’d like to talk to someone about making a will contact James McMullan in our Private Client team today.

For a larger copy of the above image, please click here, or why not use our interactive online quiz instead?

Note: This article is not legal advice; it provides information of general interest about current legal issues.