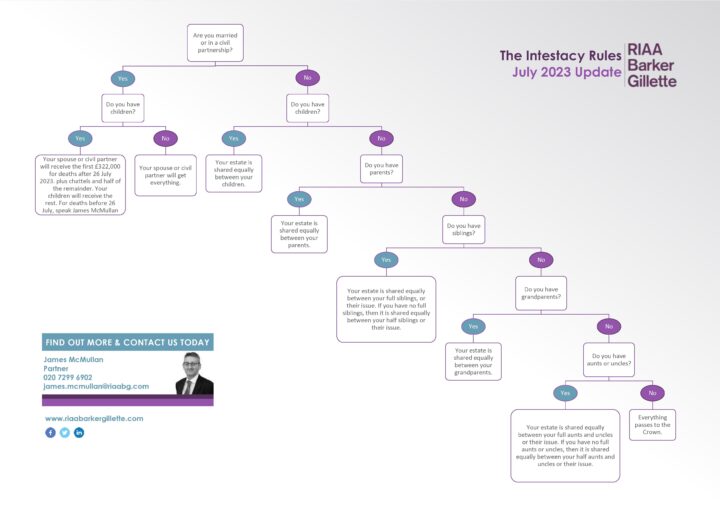

It is thought that nearly 60% of adults in the UK do not have a will. Therefore, when the inevitable happens, and you have not created a will, your death creates an intestacy. This means that the assets and belongings in your sole name and your share of any assets in joint names are distributed in accordance with the Intestacy Rules.

For a larger image of the above picture, please click here.

While this outcome may suit some, the Intestacy Rules are not the most tax-efficient way to distribute your assets. Further, the rules can seem outdated and arbitrary as they do not cater to cohabiting couples or long-term relationships.

If you are cohabiting or in a long-term relationship, you must create a will to ensure that your partner (and any children) are catered for following your death.

Why make a will?

If the Intestacy Rules do not distribute your assets as you would like, you must create a will. This will give both you and your loved ones peace of mind. Losing a loved one is difficult enough. A will can provide loved ones with a form of security to know that they will be supported even after you are gone.

A will can go beyond the scope of financial aspects and appoint guardians to look after young children and manage their financial affairs.

In general, your finances and your will should be reviewed every 18 to 24 months and always on a major life-changing event such as a birth, marriage, divorce or death or an increase in wealth. Taking the time to think about your assets will also prompt you to think about the Inheritance Tax liability of your estate.

Taxes after death

In England and Wales, Inheritance Tax is charged on all your assets in your sole name and your share of any assets in joint names. The first £325,000 (the current Nil Rate Band) of your assets are charged at 0%, and the remaining balance is charged at 40%. The percentage of any unused nil rate band can be transferred to a surviving spouse or civil partner. Thus, with some simple tax planning, you can potentially double the Nil Rate Band to £650,000. Other reliefs and exemptions can reduce the value of your estate charged at 40%.

One way of doing this is by utilising your residential nil rate band (also known as the “additional threshold”). This relief can increase the value of the estate charged at 0% by £125,000. However, this relief is available subject to certain requirements being met. Speak to one of our estate planning solicitors to find out more.

Lifetime gifts

Another well-known estate planning technique is to make lifetime gifts. This is often referred to as the seven-year rule. Again, care should be taken when making lifetime gifts, as any gifts that are subject to a reservation (such as parents who gift their house to their children but reserve the right to live in it as if it’s their own) will be clawed back into the estate for Inheritance Tax calculation purposes. Further, there are occasions when HMRC can inquire about gifts made beyond the seven-year period. Ideally, both the donor and recipient of the gift should receive independent legal advice before making a gift to reduce Inheritance Tax liability.

Why instruct solicitors?

While creating an online “do it yourself” will is cheaper, a carefully crafted will and good estate planning advice will help you reduce your estate’s Inheritance Tax liability.

Good estate planning will ensure that you fully utilise the many other Inheritance Tax exemptions and reliefs available to you, which are not covered by this note due to their number.

Further, professional advice will reduce the risk of creating an invalid will, which does not fully comply with the requirements of the Wills Act 1837. A non-compliant will results in the whole estate being distributed under the Intestacy Rules. Similarly, a partial intestacy can also be created with a poorly drafted will. This means that some assets will pass under the will, and the remaining assets will pass under the Intestacy Rules.

Finally, there has recently been an increase in the number of claims made against an estate under the Inheritance (Provision for Family and Dependants) Act 1975. Individuals can claim under this act when they believe the Intestacy Rules or the will has not made a reasonable financial provision for them. It is important to consider this when making a will in an attempt to mitigate potential claims.

For more information, contact James McMullan today.

Note: This is not legal advice; it is intended to provide information of general interest about current legal issues.